Outline:

1. Introduction

- Importance of financial literacy for young Indians

- Why investing is crucial for wealth building

- Common misconceptions about investing

2. The Power of Investing Early

- Benefits of compounding

- Long-term vs. short-term investment strategies

- How early investments shape financial independence

3. Why Stocks Are a Great Investment Option

- Understanding stock market basics

- High returns compared to traditional savings

- Risks and rewards of stock investing

4. Crypto Investment: A Revolutionary Opportunity

- What is cryptocurrency?

- Why young investors are drawn to crypto

- Risks involved and how to manage them

5. Mutual Funds: A Safer and Balanced Option

- How mutual funds work

- Why they are ideal for beginners

- SIPs and long-term wealth creation

6. Comparing Stocks, Crypto, and Mutual Funds

- Key differences between the three investment types

- Risk-reward ratio analysis

- Which one suits different types of investors?

7. The Role of Inflation and Wealth Creation

- How inflation affects savings

- Why investing is necessary to beat inflation

- Historical data on investment vs. inflation

8. Overcoming Investment Fears and Myths

- Common investment myths

- How to start with small investments

- Real-life success stories

9. The Importance of Diversification

- Reducing risk by investing in multiple assets

- Asset allocation strategies for young investors

- Why diversification is crucial for long-term stability

10. The Role of Technology in Investing

- Best apps and platforms for investing

- How AI and robo-advisors help in decision-making

- Automating investments for better discipline

11. Tax Benefits of Investing in India

- Tax advantages of stocks, mutual funds, and crypto

- How to maximize tax savings with smart investments

- Government schemes supporting young investors

12. Investment Mistakes to Avoid

- Emotional investing and market speculation

- Not doing proper research

- Ignoring diversification and risk management

13. Steps to Start Investing in India

- Opening a Demat account

- Choosing the right investment strategy

- Building a solid portfolio

14. The Future of Investing for Indian Youth

- Market trends shaping investment opportunities

- Why financial education is key

- How young investors can drive economic growth

15. Conclusion

- Recap of why investing is essential

- Encouragement to start early

- Final thoughts on smart investing

1. Introduction

India is home to the world’s largest youth population, and with economic growth accelerating, young Indians have an unprecedented opportunity to build wealth. Yet, many still hesitate to invest, fearing risks or lacking knowledge.

Investing in stocks, cryptocurrency, and mutual funds can help young individuals secure their financial future, fight inflation, and achieve financial independence. In this guide, we will explore why Indian youngsters should start investing early and how they can benefit from different investment options.

2. The Power of Investing Early

One of the most significant advantages young investors have is time. The earlier you start investing, the greater the potential for wealth accumulation due to compounding—where your earnings generate even more earnings over time.

Benefits of Compounding

If a 20-year-old invests ₹5,000 per month in a mutual fund with a 12% annual return, they could accumulate over ₹3 crores by the age of 60. In contrast, if they start at 30, they might only get around ₹1 crore.

Long-Term vs. Short-Term Investing

- Long-term investments (10+ years) yield higher and stable returns.

- Short-term investments may provide quick profits but carry higher risks.

How Early Investments Lead to Financial Freedom

Investing early enables:

- Retirement at a younger age

- Higher purchasing power (homes, cars, education)

- A safety net for unexpected expenses

3. Why Stocks Are a Great Investment Option

Understanding Stock Market Basics

Stocks represent ownership in a company, and as the company grows, so does the stock price. Investors earn through:

- Capital appreciation (price increase over time)

- Dividends (profit-sharing by companies)

Higher Returns Than Traditional Savings

Compared to savings accounts (which offer 2-4% returns), stock investments have historically yielded 12-15% annually over the long term.

Risks and How to Manage Them

- Market Volatility: Invest for the long term to reduce risk.

- Stock Selection: Research companies before investing.

- Diversification: Invest in multiple stocks instead of just one.

4. Crypto Investment: A Revolutionary Opportunity

Cryptocurrency is a decentralized digital asset that has gained global attention due to its high returns and innovative technology.

Why Young Investors Love Crypto

- High potential for growth (Bitcoin surged from ₹50,000 to ₹50 lakhs in a decade!)

- 24/7 trading (Unlike the stock market, crypto is always open)

- Technological innovation (Blockchain security)

Risks Involved and Risk Management

- Extreme volatility: Prices can fluctuate wildly.

- Regulatory uncertainties: Government policies may impact the market.

- Scams and frauds: Only invest in reputable projects.

5. Mutual Funds: A Safer and Balanced Option

What Are Mutual Funds?

Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, and other assets.

Why They Are Ideal for Beginners

- Managed by experts (no need for deep market knowledge)

- Less risky than individual stocks

- Easy to start with as little as ₹500 via SIPs

Systematic Investment Plans (SIPs) for Wealth Creation

- Investing ₹5,000 per month in a SIP for 20 years at 12% return can grow to ₹50+ lakhs.

- Ideal for salaried individuals and students starting small.

Continue Generating?

You said:

ChatGPT said:

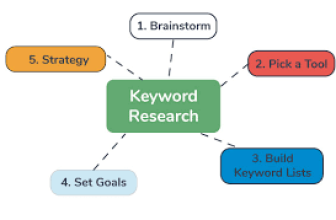

6. Comparing Stocks, Crypto, and Mutual Funds

Before diving into any investment, it’s crucial to understand how stocks, cryptocurrencies, and mutual funds differ. Each investment vehicle offers unique benefits and risks.

Key Differences Between the Three Investment Types

| Feature | Stocks | Cryptocurrencies | Mutual Funds |

|---|---|---|---|

| Risk Level | High | Very High | Moderate to Low |

| Returns | 12-15% (historically) | Can exceed 100% but volatile | 10-12% (long term) |

| Investment Knowledge Needed | High | High | Low (managed by experts) |

| Liquidity | High | Very High | Moderate |

| Best for | Growth investors | Risk-takers & tech enthusiasts | Beginners & risk-averse investors |

Which One is Best for Young Investors?

- If you like calculated risks and want high returns, stocks are a great option.

- If you are comfortable with volatility and technology, crypto could be a profitable investment.

- If you prefer stability and professional management, mutual funds are your best bet.

7. The Role of Inflation and Wealth Creation

Inflation decreases the value of money over time. If you keep your savings in a bank account earning 3-4% interest, but inflation is at 6-7%, you are actually losing money in real terms.

Why Investing is Necessary to Beat Inflation

- Stock market investments have historically outpaced inflation with annual returns of 12-15%.

- Mutual funds, especially equity funds, generate higher returns than traditional savings.

- Cryptocurrencies are seen as digital gold, offering hedge potential against inflation.

Real-Life Example

If you had kept ₹1 lakh in a savings account 10 years ago, today its purchasing power would be around ₹50,000 due to inflation. However, if that money had been invested in stocks or mutual funds, it could be worth ₹3-5 lakhs today!

8. Overcoming Investment Fears and Myths

Many young Indians avoid investing due to misconceptions like:

- “Investing is only for the rich.” → No! You can start with as little as ₹100 in stocks and ₹500 in mutual funds.

- “The stock market is gambling.” → Not true! Stocks grow based on company performance and economic factors.

- “Crypto is a scam.” → While some projects are risky, Bitcoin and Ethereum have become mainstream investment options.

How to Start Investing Without Fear

- Start small – Invest only what you can afford to lose initially.

- Learn continuously – Follow market trends and understand different assets.

- Diversify – Don’t put all your money in one asset type.

9. The Importance of Diversification

“Diversification is the only free lunch in investing.” – Warren Buffett

Why Should You Diversify?

- Reduces risk by spreading investments across different assets.

- Protects against losses in one asset class.

- Ensures a balanced portfolio for long-term stability.

Asset Allocation Strategies for Young Investors

- High-risk takers (age 18-25): 60% stocks, 30% crypto, 10% mutual funds.

- Moderate-risk takers (age 26-35): 50% stocks, 20% crypto, 30% mutual funds.

- Low-risk takers (35+ years): 30% stocks, 10% crypto, 60% mutual funds.

10. The Role of Technology in Investing

Thanks to digital platforms, investing is now easier than ever.

Best Investment Apps for Indian Youngsters

- Zerodha & Upstox – Best for stock trading.

- CoinDCX & WazirX – Leading crypto exchanges.

- Groww & Paytm Money – Best for mutual fund investments.

Automating Investments for Better Financial Discipline

- SIP auto-deductions ensure regular savings.

- Robo-advisors provide AI-driven investment recommendations.

- Budgeting apps help track spending and allocate money efficiently.

Continue Generating?

You said:

ChatGPT said:

11. Tax Benefits of Investing in India

Investing not only helps grow wealth but also provides tax-saving benefits under Indian tax laws.

Tax Advantages of Different Investments

| Investment Type | Tax Benefits |

|---|---|

| Stocks | Long-term capital gains (LTCG) on stocks (above ₹1 lakh) are taxed at 10%. Short-term gains (less than 1 year) are taxed at 15%. |

| Mutual Funds | Equity-linked savings schemes (ELSS) offer tax benefits under Section 80C (up to ₹1.5 lakh deduction). Debt mutual funds have different tax rates based on holding period. |

| Cryptocurrency | Crypto gains are taxed at 30% flat rate, with no deductions allowed. |

How to Maximize Tax Savings with Smart Investments

- Invest in ELSS funds to reduce taxable income.

- Hold stocks and mutual funds for over a year to get lower tax rates.

- Use tax-saving investment platforms to track and optimize your tax liabilities.

12. Investment Mistakes to Avoid

Common Mistakes Made by Young Investors

- Emotional Investing – Buying or selling based on fear or hype.

- Not Researching Enough – Investing in stocks or crypto without understanding fundamentals.

- Ignoring Diversification – Putting all money into a single stock or crypto asset.

- Overtrading – Constantly buying and selling, leading to losses.

- Not Having a Long-Term Plan – Expecting quick profits instead of focusing on sustainable growth.

How to Avoid These Mistakes?

- Educate Yourself – Follow finance news, read investment books, and learn from experienced investors.

- Think Long-Term – Invest with a time horizon of 5-10 years rather than chasing short-term gains.

- Start Small – Begin with small amounts and gradually increase investments.

13. Steps to Start Investing in India

Step 1: Open a Demat and Trading Account

- Use platforms like Zerodha, Groww, or Upstox.

- Complete KYC verification (PAN card, Aadhaar, bank details).

Step 2: Choose Your Investment Strategy

- For beginners: Start with mutual funds and blue-chip stocks.

- For tech-savvy investors: Explore crypto but with caution.

- For high-risk investors: Invest in growth stocks and new-age companies.

Step 3: Build a Solid Portfolio

- Allocate funds across stocks, mutual funds, and crypto.

- Regularly monitor and rebalance your investments.

- Stay updated on market trends and government policies.

14. The Future of Investing for Indian Youth

Market Trends Shaping Investment Opportunities

- Digital transformation is making investing more accessible.

- Government support for startups and fintech innovations is creating new asset classes.

- Growing awareness about financial independence among youth is increasing investments.

Why Financial Education is Key for Young Investors

- Helps make informed investment decisions.

- Reduces dependency on traditional savings methods.

- Encourages early wealth-building habits.

How Young Investors Can Drive Economic Growth

- Investing in Indian companies helps boost the economy.

- Startups funded by retail investors contribute to job creation.

- Financially independent youth create a stronger, wealthier nation.

15. Conclusion

Indian youngsters have an incredible opportunity to secure their financial future by investing in stocks, crypto, and mutual funds. These investment options offer different risk-reward ratios, allowing individuals to choose based on their financial goals and risk appetite.

By starting early, leveraging compounding, and diversifying their investments, young investors can beat inflation and build substantial wealth over time.

Final Advice:

- Don’t wait—start investing now! Even small amounts can grow significantly over the years.

- Educate yourself about investment risks and market trends.

- Diversify your portfolio to minimize risks and maximize returns.

By making smart financial choices today, Indian youth can shape a wealthier and more secure future for themselves.

FAQs

1. Is it safe for Indian youngsters to invest in crypto?

Crypto investments carry high risk due to volatility. If investing, start small, choose reputed cryptocurrencies like Bitcoin and Ethereum, and stay updated on regulations.

2. How much money do I need to start investing?

You can start investing in stocks with ₹100, mutual funds with ₹500 (SIP), and crypto with as little as ₹100.

3. What are the best investment options for students?

Students can begin with mutual funds (ELSS, SIPs) and low-cost index funds for stable growth. Stocks and crypto can be explored gradually with small investments.

4. Should I invest in stocks or mutual funds?

If you have time to research and take risks, stocks are a good option. If you prefer professional management and lower risks, mutual funds are ideal.

5. How long should I hold my investments?

For stocks and mutual funds, a minimum of 5-10 years is recommended for significant returns. Crypto investments should be held with a strategy, considering market cycles.