Outline:

-

Introduction

- Overview of financial markets

- Importance of real-time price updates

-

Understanding the Stock Market

- How stock trading works

- Key factors affecting stock prices

-

Live Stock Market Updates

- Major stock indices performance

- Sectors driving the market

-

Investment Strategies for Stock Trading

- Short-term vs. long-term strategies

- Risk management in stock trading

-

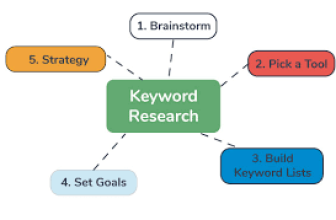

Bitcoin and Cryptocurrency Market Overview

- What influences Bitcoin price fluctuations?

- Comparing crypto to traditional stocks

-

Live Crypto Price Updates

- Bitcoin, Ethereum, and Altcoin performance

- NFT market trends and impact on crypto prices

-

Financial Analysis in Stock and Crypto Markets

- Fundamental vs. technical analysis

- How to interpret market signals

-

Blockchain Technology and Market Influence

- How blockchain is transforming finance

- Role of DeFi (Decentralized Finance) in market trends

-

Stock Market vs. Crypto Market: Key Differences

- Volatility and risk factors

- Profit potential and long-term value

-

Market Trends and Future Predictions

- Expected stock market trends

- Future of Bitcoin and cryptocurrency investments

-

Best Tools for Live Market Tracking

- Websites and apps for stock and crypto updates

- Importance of AI in market predictions

-

Impact of Global Events on Financial Markets

- Economic policies affecting stock prices

- Crypto regulations and their impact

-

Common Mistakes to Avoid in Trading

- Emotional trading and impulsive decisions

- Lack of research and poor risk management

-

Beginner’s Guide to Entering Stock and Crypto Markets

- Steps to start investing in stocks

- How to buy and trade cryptocurrencies

-

Conclusion and Final Thoughts

- Summary of market importance

- Encouragement for informed investing

Introduction

The stock and cryptocurrency markets are the heartbeat of the financial world, shaping investment decisions and economic policies worldwide. Whether you’re a seasoned investor or just getting started, staying updated with live stock market & crypto price updates is crucial. With rapid changes in stock trading, Bitcoin news, and NFT market trends, investors need real-time data to make informed decisions.

In this article, we will explore everything from investment strategies to market trends and financial analysis to help you navigate the complex world of stocks and crypto.

Understanding the Stock Market

Stock trading is one of the oldest and most established ways of investing. It involves buying and selling shares of publicly traded companies through stock exchanges like the New York Stock Exchange (NYSE) or Nasdaq.

How Stock Trading Works

- Companies issue shares to raise capital, and investors buy them to own a portion of the company.

- Stock prices fluctuate based on supply and demand, influenced by company performance, investor sentiment, and market conditions.

- Investors trade stocks through brokerage accounts, either manually or using automated trading systems.

Key Factors Affecting Stock Prices

- Earnings reports – Company profits and losses impact investor confidence.

- Economic indicators – Inflation rates, interest rates, and GDP growth affect the market.

- Political and global events – Trade wars, elections, and crises influence stock performance.

- Market sentiment – Fear and greed drive stock price movements.

Live Stock Market Updates

Tracking live stock prices is essential for investors who want to capitalize on market opportunities. Here’s what to look for in daily updates:

Major Stock Indices Performance

- S&P 500 – Tracks 500 of the largest U.S. companies.

- Dow Jones Industrial Average (DJIA) – Represents 30 major U.S. companies.

- Nasdaq Composite – Heavily focused on technology stocks.

Sectors Driving the Market

- Technology – Companies like Apple, Microsoft, and Tesla influence Nasdaq trends.

- Healthcare – Biotech and pharmaceutical stocks impact market health.

- Finance – Banking and investment firms shape economic strength.

Real-time data from market analysis tools helps investors spot trends, make adjustments, and plan their trading strategies effectively.

Investment Strategies for Stock Trading

Short-Term vs. Long-Term Strategies

- Day Trading – Buying and selling stocks within the same day to capitalize on small price movements.

- Swing Trading – Holding stocks for days or weeks based on short-term trends.

- Long-Term Investing – Holding stocks for years to benefit from overall market growth.

Risk Management in Stock Trading

- Diversification – Spreading investments across multiple sectors to reduce risk.

- Stop-Loss Orders – Setting price limits to minimize potential losses.

- Market Research – Using financial analysis tools to make data-driven decisions.

Bitcoin and Cryptocurrency Market Overview

Cryptocurrency has transformed the financial world, offering an alternative to traditional investments. Bitcoin, Ethereum, and the NFT market are leading the way in digital asset trading.

What Influences Bitcoin Price Fluctuations?

- Market demand – Increased adoption drives Bitcoin prices higher.

- Regulatory news – Government policies can affect crypto value.

- Institutional investment – Companies like Tesla and MicroStrategy influence Bitcoin price trends.

Comparing Crypto to Traditional Stocks

| Factor | Stock Market | Cryptocurrency Market |

|---|---|---|

| Volatility | Moderate | High |

| Regulation | Heavily regulated | Lightly regulated |

| Market Hours | 9:30 AM – 4 PM EST | 24/7 trading |

| Investment Type | Equity ownership | Digital asset |

Unlike stocks, crypto operates 24/7, making it more volatile but also providing greater opportunities for high returns.

Live Crypto Price Updates

Real-time crypto price updates allow traders to seize profitable moments. Here’s what’s trending now:

Bitcoin, Ethereum, and Altcoin Performance

- Bitcoin (BTC) – The most valuable cryptocurrency, often considered digital gold.

- Ethereum (ETH) – Supports smart contracts and decentralized applications.

- Altcoins – Cryptos like Solana, Cardano, and Polkadot are gaining traction.

NFT Market Trends and Impact on Crypto Prices

- NFTs (Non-Fungible Tokens) are driving crypto adoption.

- Ethereum gas fees impact NFT trading costs.

- Celebrity and brand involvement increase NFT market demand.

Live updates on crypto exchanges like Binance, Coinbase, and Kraken help traders stay ahead of the game.

Continue Generating?

You said:

ChatGPT said:

Financial Analysis in Stock and Crypto Markets

Successful trading requires deep financial analysis to understand market trends, investment risks, and profit opportunities. Traders use two primary types of analysis:

Fundamental vs. Technical Analysis

- Fundamental Analysis – Examines a company’s financial health, including earnings reports, revenue, market position, and economic conditions.

- Technical Analysis – Focuses on chart patterns, historical price movements, and trading volumes to predict future trends.

How to Interpret Market Signals

- Bullish vs. Bearish Trends – Rising prices indicate a bullish market, while falling prices suggest a bearish market.

- Moving Averages – Helps smooth out price data to identify market trends.

- Relative Strength Index (RSI) – Measures whether an asset is overbought or oversold.

By leveraging financial analysis, traders minimize risks and maximize profits in both stock and crypto markets.

Blockchain Technology and Market Influence

Blockchain is the backbone of the crypto market, and its adoption is reshaping global finance. It is a decentralized ledger system that ensures transparency, security, and efficiency in transactions.

How Blockchain is Transforming Finance

- Smart Contracts – Automated contracts that execute transactions without intermediaries.

- Decentralized Exchanges (DEXs) – Platforms like Uniswap allow users to trade crypto without a central authority.

- Secure Transactions – Reduces fraud and enhances data integrity.

Role of DeFi (Decentralized Finance) in Market Trends

- Lending and Borrowing – Platforms like Aave and Compound offer decentralized financial services.

- Yield Farming – Users earn passive income by providing liquidity to DeFi platforms.

- Stablecoins – Digital assets pegged to real-world currencies help stabilize crypto markets.

Blockchain technology is driving the future of finance, influencing both crypto and traditional investment strategies.

Stock Market vs. Crypto Market: Key Differences

Understanding the differences between the stock and crypto markets helps investors choose the right investment strategy.

| Feature | Stock Market | Cryptocurrency Market |

|---|---|---|

| Regulation | Highly regulated | Lightly regulated |

| Trading Hours | 9:30 AM – 4 PM EST | 24/7 Trading |

| Volatility | Moderate | High |

| Asset Type | Company Shares | Digital Assets |

| Long-Term Growth | Stable Growth | Uncertain, High ROI |

While stocks provide stability and long-term wealth, crypto offers higher risk but greater short-term profit potential.

Market Trends and Future Predictions

Keeping an eye on market trends helps traders make smart investment choices.

Expected Stock Market Trends

- Rise in AI and Tech Stocks – Companies investing in AI, such as Google and Nvidia, are expected to perform well.

- Green Energy Investments – Stocks in renewable energy sectors are gaining traction.

- Inflation Impact – Rising interest rates may affect market performance.

Future of Bitcoin and Cryptocurrency Investments

- Mass Adoption – More businesses are accepting crypto payments.

- Institutional Investments – Banks and financial firms are investing in Bitcoin and Ethereum.

- Government Regulations – New laws may influence crypto price stability.

Staying updated on market trends helps investors adapt and thrive in changing economic conditions.

Best Tools for Live Market Tracking

Using the right tools can give traders a competitive edge.

Websites and Apps for Stock and Crypto Updates

- Yahoo Finance – Provides real-time stock market news.

- TradingView – Best for technical analysis and charting.

- CoinMarketCap – Tracks crypto prices and market cap rankings.

Importance of AI in Market Predictions

- AI-Powered Trading Bots – Automates trades based on data analysis.

- Sentiment Analysis Tools – Detects market sentiment from social media trends.

- Machine Learning Algorithms – Predicts price movements based on past data.

These tools help traders make smarter and faster investment decisions.

Impact of Global Events on Financial Markets

Financial markets are heavily influenced by global economic and political events.

Economic Policies Affecting Stock Prices

- Federal Reserve Decisions – Interest rate hikes impact stock market performance.

- Trade Agreements – International trade deals affect company earnings.

- Economic Crises – Recessions and pandemics create market volatility.

Crypto Regulations and Their Impact

- Government Bans – Countries like China have restricted crypto trading.

- Tax Policies – New tax laws may affect crypto investors’ profits.

- Institutional Adoption – Regulations could drive mainstream adoption.

Global events create investment risks and opportunities, requiring traders to stay alert and informed.

Common Mistakes to Avoid in Trading

Many traders lose money due to avoidable mistakes.

Emotional Trading and Impulsive Decisions

- Fear and Greed – Emotional reactions lead to poor investment choices.

- Overtrading – Making too many trades increases risk and losses.

- Ignoring Stop-Losses – Failing to set limits can lead to huge financial losses.

Lack of Research and Poor Risk Management

- Following Hype – Investing in “trending” stocks or crypto without research.

- No Diversification – Putting all money in one asset increases risk.

- Ignoring Market Trends – Failing to analyze economic factors and technical signals.

Avoiding these mistakes can increase long-term investment success.

Beginner’s Guide to Entering Stock and Crypto Markets

New investors should take a strategic approach to trading.

Steps to Start Investing in Stocks

- Open a Brokerage Account – Platforms like Robinhood or E*TRADE make investing easy.

- Research Stocks – Study company earnings and industry trends.

- Diversify Portfolio – Invest in multiple sectors to balance risk.

- Start Small – Begin with a small amount before increasing investments.

How to Buy and Trade Cryptocurrencies

- Choose a Crypto Exchange – Coinbase, Binance, and Kraken are top choices.

- Create a Wallet – Secure crypto assets with hardware or software wallets.

- Understand Market Trends – Follow Bitcoin news and NFT market updates.

- Practice Safe Trading – Use two-factor authentication and avoid scam projects.

With proper research and strategy, beginners can profit and grow their investments.

Conclusion and Final Thoughts

The stock and crypto markets offer endless opportunities, but success requires knowledge, strategy, and real-time updates.

- Stock trading provides stable, long-term growth.

- Cryptocurrency offers high risk but high rewards.

- Financial analysis and blockchain technology are reshaping the future of investing.

By using market trends, financial tools, and smart strategies, traders can navigate the markets successfully. Stay informed, manage risks, and invest wisely!

FAQs

1. What is the best platform for stock trading?

Top platforms include Robinhood, E*TRADE, TD Ameritrade, and Charles Schwab for user-friendly trading.

2. How often should I check stock and crypto prices?

It depends on your strategy. Day traders check prices frequently, while long-term investors review trends weekly or monthly.

3. Is Bitcoin a better investment than stocks?

Bitcoin is more volatile than stocks but offers higher short-term gains. Stocks are more stable with long-term growth potential.

4. How do global events affect crypto prices?

Regulations, government policies, and major news (like institutional adoption) can significantly impact crypto prices.

5. What is the safest way to store cryptocurrency?

Using a hardware wallet (like Ledger or Trezor) is the safest way to store crypto assets securely.