Introduction

- Overview of Power Grid Corporation of India Ltd.

- Significance of the stock’s recent performance.

Current Market Performance

- Details of the 2.98% rise in share price.

- Comparison with BSE SENSEX Index performance.

- Recent trading statistics.

Historical Stock Performance

- Analysis of the 52-week high and recent trends.

- Insights into the stock’s peak performance in September.

Trading Volume Insights

- Significance of lower-than-average trading volume.

- Implications for investor sentiment.

Sector Overview

- Power Grid Corporation’s role in India’s power infrastructure.

- Comparison with peers in the utilities sector.

Key Drivers of Performance

- Analysis of recent factors influencing the stock.

- Role of government policies and infrastructure spending.

Challenges and Risks

- Factors contributing to cautious investor sentiment.

- Macro-economic challenges and sector-specific risks.

Technical Analysis

- Key support and resistance levels.

- Short-term and long-term moving averages.

Investor Sentiment

- Trends in institutional and retail investor activity.

- Insights from trading patterns.

Outlook for Power Grid Corporation

- Future growth potential.

- Expected impact of upcoming projects and initiatives.

Recommendations for Investors

- Should investors consider buying, holding, or selling?

- Risk vs. reward assessment.

Conclusion

- Summary of Power Grid Corporation’s current market standing.

- Final thoughts on its investment potential.

FAQs

- What is Power Grid Corporation’s main business focus?

- How has Power Grid Corporation’s stock performed over the last year?

- What factors are driving the recent price increase?

- Is Power Grid Corporation a good long-term investment?

- How do government policies affect Power Grid Corporation’s performance?

Power Grid Corporation’s Market Performance: An In-Depth Analysis

Introduction

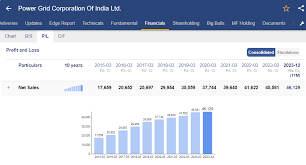

Power Grid Corporation of India Ltd., a pivotal player in India’s power transmission sector, has recently drawn investor attention due to a notable rise in its share price. The stock saw a 2.98% increase, closing at ₹298.65, outperforming the broader BSE SENSEX Index, which recorded a modest 0.29% gain to reach 76,724.08. This article explores the factors behind the stock’s performance, historical trends, and its future outlook.

Current Market Performance

Power Grid Corporation’s stock experienced a significant boost, climbing by 2.98% in a single trading session. This performance outshined the BSE SENSEX, which saw a comparatively modest increase. Despite this upward movement, the stock remains below its 52-week high of ₹366.20, achieved in September. The trading session also revealed subdued activity, with volumes falling below the 50-day average. This indicates a cautious approach by investors, possibly influenced by broader market uncertainties.

Historical Stock Performance

The stock’s 52-week high of ₹366.20, achieved last September, marked a peak in its performance trajectory. Since then, the stock has faced downward pressure, reflecting broader market trends and sector-specific challenges. Over the past year, Power Grid Corporation has demonstrated resilience amidst fluctuating market conditions, though it remains vulnerable to macroeconomic factors.

Trading Volume Insights

One of the key observations from recent trading is the lower-than-average volume. This metric often serves as a barometer for investor sentiment. Reduced activity could signal a lack of conviction among market participants, possibly due to concerns about growth prospects or sectoral headwinds. However, it may also reflect a wait-and-watch approach, with investors awaiting clearer signals about the company’s future trajectory.

Sector Overview

As a cornerstone of India’s power infrastructure, Power Grid Corporation plays a critical role in ensuring the efficient transmission of electricity across the country. Its performance is closely tied to developments in the utilities sector, which has seen steady demand growth driven by industrialization and urbanization. Compared to its peers, Power Grid Corporation enjoys a robust market position, though it faces competition from emerging private players.

Key Drivers of Performance

Several factors have contributed to the stock’s recent uptick. These include:

- Government Policies: Initiatives aimed at strengthening the power infrastructure have positively impacted the sector.

- Earnings Reports: Strong financial performance in recent quarters has bolstered investor confidence.

- Infrastructure Projects: The company’s involvement in key national projects has reinforced its growth prospects.

Challenges and Risks

Despite its strengths, Power Grid Corporation faces several challenges:

- Investor Sentiment: Lower trading volumes suggest lingering caution.

- Sectoral Risks: Regulatory changes and competition from private players could impact margins.

- Macroeconomic Factors: Rising interest rates and inflationary pressures pose additional risks.

Technical Analysis

From a technical perspective, the stock’s current price of ₹298.65 positions it below its 52-week high but within a stable range. Key support levels are observed at ₹285, while resistance is anticipated near ₹310. Moving averages suggest a neutral trend, with potential for upward movement if volumes pick up.

Investor Sentiment

Institutional and retail investor activity offers mixed signals. While some institutions have increased their stakes, retail participation remains cautious. This dichotomy highlights the need for a balanced approach when evaluating the stock’s potential.

Outlook for Power Grid Corporation

Looking ahead, Power Grid Corporation’s growth prospects appear promising, driven by government initiatives and a robust project pipeline. However, investors should remain mindful of external risks, including economic uncertainties and competitive pressures.

Recommendations for Investors

For potential investors, Power Grid Corporation presents a mixed bag. Long-term investors may find value in its strong fundamentals and growth potential, while short-term traders should consider market conditions and technical indicators before making a move. A buy-and-hold strategy could be effective for those with a high-risk tolerance.

Conclusion

Power Grid Corporation’s recent market performance underscores its resilience and potential as a key player in India’s utilities sector. While challenges persist, the company’s strategic initiatives and robust infrastructure projects position it well for future growth. Investors should weigh the risks and rewards carefully before making decisions.

FAQs

What is Power Grid Corporation’s main business focus?

Power Grid Corporation specializes in the transmission of electricity across India, playing a vital role in the country’s power infrastructure.How has Power Grid Corporation’s stock performed over the last year?

The stock has shown resilience but remains below its 52-week high, reflecting broader market trends.What factors are driving the recent price increase?

Strong financial performance, government policies, and involvement in key projects have contributed to the stock’s rise.Is Power Grid Corporation a good long-term investment?

Yes, for investors with a high-risk tolerance, its strong fundamentals and growth potential make it an attractive option.How do government policies affect Power Grid Corporation’s performance?

Favorable policies, such as investments in power infrastructure, directly boost the company’s growth and profitability.