The share market, often referred to as the stock market, is a hub of financial activity where shares of publicly traded companies are bought and sold. It serves as a crucial platform for businesses to raise capital and for investors to build wealth. Understanding the share market and identifying profitable investment opportunities are essential steps toward achieving financial goals.

Understanding the Share Market

What is the Share Market?

The share market is a marketplace where investors trade equity securities issued by companies. It is divided into two primary segments:

- Primary Market: Where companies issue new shares through Initial Public Offerings (IPOs).

- Secondary Market: Where existing shares are traded among investors.

How Does the Share Market Work?

The stock market operates through exchanges like the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) in India. Buyers and sellers interact through brokers, and trades are executed based on supply and demand.

Key Participants in the Share Market

- Retail Investors: Individual investors who trade for personal wealth growth.

- Institutional Investors: Entities like mutual funds, insurance companies, and banks.

- Market Regulators: Bodies like the Securities and Exchange Board of India (SEBI) ensure fair trading practices.

Benefits of Investing in the Share Market

- Wealth Creation: Stocks offer the potential for significant capital appreciation over time.

- Dividend Income: Some companies distribute profits to shareholders as dividends.

- Liquidity: Shares can be easily bought and sold in the market.

- Diversification: Investing in different sectors reduces risk.

Identifying Profitable Stocks

Selecting the right stocks is critical for achieving profitable returns. Below, we highlight promising stocks under ₹100, ₹500, and ₹1000.

Top Profitable Stocks Under ₹100

Stocks priced under ₹100 are often referred to as penny stocks. They can provide high returns but carry higher risks.

Examples of Profitable Stocks Under ₹100

Rail Vikas Nigam Limited (RVNL)

- Sector: Infrastructure

- Reason to Buy: Consistent government contracts and infrastructure growth.

- Potential: High growth due to India’s focus on railway development.

IDFC Limited

- Sector: Financial Services

- Reason to Buy: Strategic restructuring and strong fundamentals.

- Potential: Long-term growth from improved financial sector outlook.

NHPC Limited

- Sector: Power

- Reason to Buy: Strong renewable energy portfolio and government support.

- Potential: Growth aligned with the renewable energy boom.

Risks with Stocks Under ₹100

- High volatility and lower liquidity.

- Potential for significant losses due to market speculation.

Top Profitable Stocks Under ₹500

Stocks under ₹500 often strike a balance between affordability and growth potential.

Examples of Profitable Stocks Under ₹500

Tata Power Company Limited

- Sector: Energy

- Reason to Buy: Leadership in renewable energy projects.

- Potential: Benefits from India’s clean energy initiatives.

Canara Bank

- Sector: Banking

- Reason to Buy: Strong asset quality and robust recovery strategies.

- Potential: Steady growth with rising credit demand.

Ashok Leyland Limited

- Sector: Automotive

- Reason to Buy: Dominance in the commercial vehicle market.

- Potential: Growth due to increasing infrastructure investments.

Crompton Greaves Consumer Electricals

- Sector: Consumer Goods

- Reason to Buy: Strong brand presence and diversified product portfolio.

- Potential: Long-term gains from rising consumer demand.

Top Profitable Stocks Under ₹1000

Stocks priced under ₹1000 offer a mix of stability and growth, making them ideal for mid-range investors.

Examples of Profitable Stocks Under ₹1000

HDFC Bank Limited

- Sector: Banking

- Reason to Buy: Market leader with consistent growth and strong fundamentals.

- Potential: Long-term value from India’s growing banking sector.

Infosys Limited

- Sector: IT Services

- Reason to Buy: Global IT services leader with strong earnings potential.

- Potential: Benefits from digital transformation trends.

Tata Motors Limited

- Sector: Automotive

- Reason to Buy: Strong growth in electric vehicle (EV) segment.

- Potential: Long-term growth with global EV expansion.

Bharat Electronics Limited (BEL)

- Sector: Defense and Electronics

- Reason to Buy: Government contracts and robust order book.

- Potential: Growth aligned with India’s defense modernization.

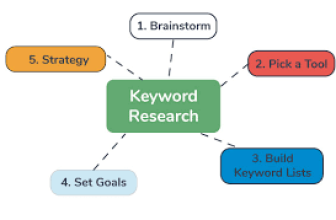

How to Identify Profitable Stocks

- Fundamental Analysis: Assess the company’s financial health through metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio.

- Technical Analysis: Study price patterns and volume data to identify buying opportunities.

- Industry Trends: Invest in sectors with strong growth potential, such as renewable energy, technology, and infrastructure.

- Management Quality: Research the company’s leadership and their track record in delivering growth.

Strategies for Investing in the Share Market

- Diversify Your Portfolio: Spread investments across different sectors and market caps to reduce risk.

- Invest for the Long Term: Holding stocks for several years often yields higher returns.

- Stay Updated: Monitor market trends, economic developments, and company performance regularly.

- Use Stop Losses: Protect your investments by setting predefined exit points for minimizing losses.

Conclusion

The share market offers immense opportunities for wealth creation, but success depends on informed decision-making and disciplined investment strategies. Stocks under ₹100, ₹500, and ₹1000 cater to different risk appetites and financial goals, making them accessible to a wide range of investors. By conducting thorough research, staying patient, and following sound investment principles, you can achieve profitable returns and secure your financial future.

FAQs

1. What are the benefits of investing in low-cost stocks?

Low-cost stocks provide opportunities for high returns, especially for small investors. However, they require careful research to mitigate risks.

2. How do I start investing in the share market?

Open a Demat and trading account, research stocks, and begin with small investments to gain experience.

3. Can I lose all my money in the share market?

While the market carries risks, diversification and informed decisions can minimize potential losses.

4. How long should I hold my stocks?

The holding period depends on your financial goals and the stock’s performance. Long-term holding generally offers better returns.

5. Are dividends important in stock selection?

Yes, dividend-paying stocks provide a steady income stream and indicate a company’s financial stability.